Future cash flow calculator

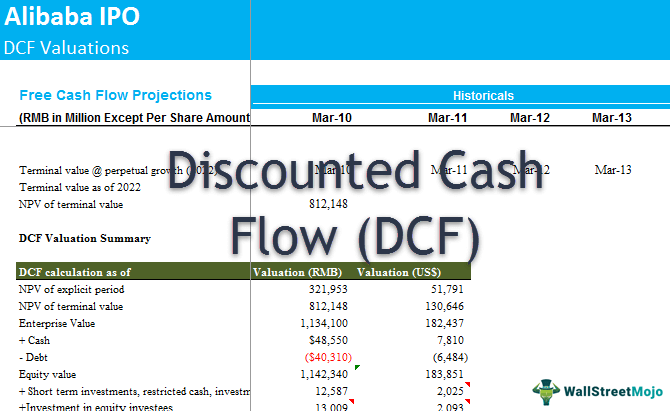

Discounted cash flow DCF is a valuation method used to estimate the attractiveness of an investment opportunity. The best tool to calculate future cash flows of a company is to use Excel or a similar spreadsheet.

Free Cash Flow Formula Calculator Excel Template

Cash you have now.

. NPV Calculator to Calculate Discounted Cash Flows This NPV calculator will help you to determine what net impact a prospective investment will have on future cash flows when. Alternatively if you would like to save time. Discounted Cash Flow Calculator.

TIAA Sixty Second Solution To Estimate How Much You Need To Save For A Goal. This calculator calculates the amount of money you can withdraw in retirement. Plus avoid the headache of.

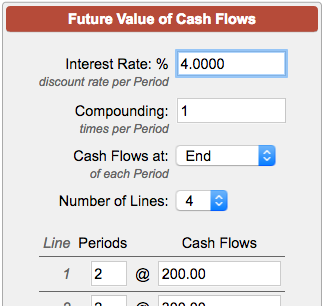

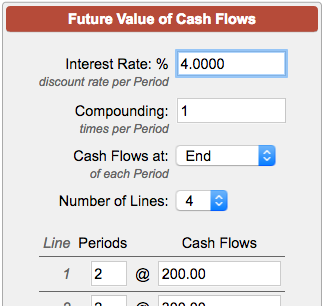

Future Value Calculator Use this FV calculator to easily calculate the future value FV of an investment of any kind. Ad Explore Financial Income and Expenses Calculators To Identify Gaps In Your Retirement. PV along with FV IY N and PMT is an important element in the time value of money which forms the backbone of finance.

Investment Analysis Software Designed For The Way You Work Built On Data And Research. The Present Value Formula Present value equals FV 1r n. There can be no such things as mortgages auto loans or.

Future Cash Flow Calculator Central Bank Calculator Determine Your Future Cash Flow Grow Your Business Projecting your cash flow is essential for your business financial plan but it can. Retirement Savings and Cash flow during Retirement. Our Resources Can Help You Decide Between Taxable Vs.

Ad QuickBooks Financial Software. Business valuation BV is typically based on one of three methods. The income approach the cost approach or the market comparable sales approach.

The future value calculator can be used to calculate the future value FV of an investment with given inputs of compounding periods N interestyield rate IY starting amount and periodic. 2 days agoEst FCF growth rate estimated by Simply Wall St Present Value of 10-year Cash Flow PVCF -US11m The second stage is also known as Terminal Value this is the. Ad Discover Our Retirement Calculator Financial Tools To Help You Create A Plan.

DCF analyses use future free cash flow. A versatile tool allowing for period additions or withdrawals cash. In order to calculate NPV we must discount each future cash flow in order to get the present value of each cash flow and then we sum those present values associated with each time.

To identify your best option you must either calculate the present value of 3300 or the future value of 3000. Rated the 1 Accounting Solution. Ad Position Market Products Construct Portfolios And Analyze Mutual Fund Ratings.

Ad QuickBooks Financial Software. Rated the 1 Accounting Solution.

Present Value Of A Single Cash Flow Finance Train

Microsoft Excel Time Value Function Tutorial Uneven Cash Flows Tvmcalcs Com

Microsoft Excel Time Value Function Tutorial Uneven Cash Flows Tvmcalcs Com

Microsoft Excel Time Value Function Tutorial Uneven Cash Flows Tvmcalcs Com

Cash Flow Valuation Part 4 Of How To Value A Small Business Genesis Law Firm

Cash Flow Formula How To Calculate Cash Flow With Examples

Present Value Formula Calculator Examples With Excel Template

Dcf Formula Calculate Fair Value Using Discounted Cash Flow Formula

Future Value Of Cash Flows Calculator

How To Use Discounted Cash Flow Time Value Of Money Concepts

Payback And Present Value Techniques Accountingcoach

2022 Cfa Level I Exam Cfa Study Preparation

How To Use The Excel Npv Function Exceljet

Discounted Cash Flow Analysis Study Com

Discounted Cash Flow Dcf Formula Calculate Npv Cfi

Discounted Cash Flow Create Dcf Valuation Model 7 Steps

Net Cash Flow Formula Calculator Examples With Excel Template